The Third Places: Retailers Search for Creative Updates to Store Format

Try TrafficZoom’s AADT metrics today with a free trial

Get instant access nowIn 1849, French writer Jean-Baptiste Alphonse Karr wrote “plus ça change, plus c’est la même chose “ – the more things change, the more they stay the same.

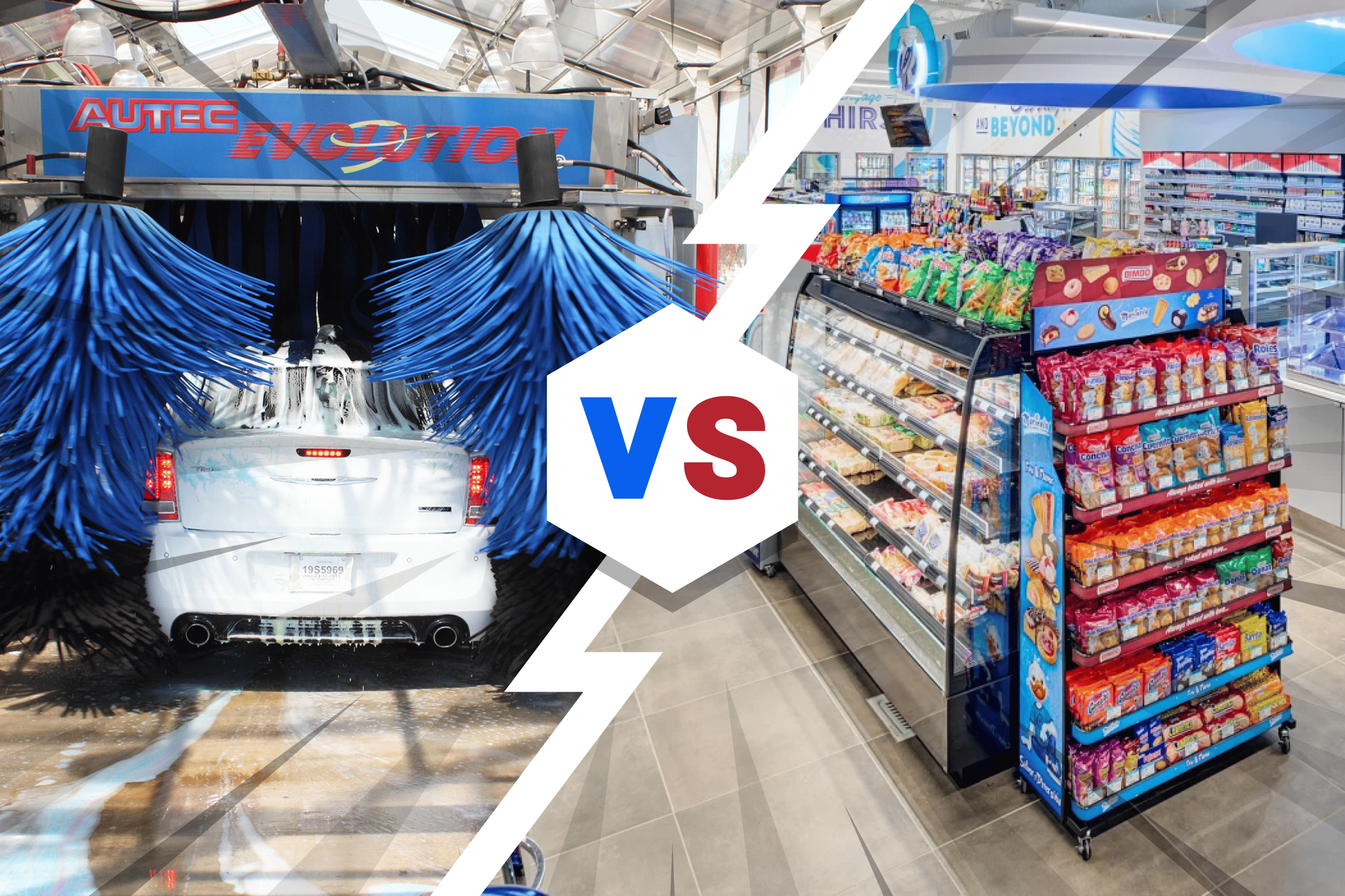

170 years later, as applied to the retail marketplace, it may be paraphrased as “The more stores try to be different, the more they resemble each other”. As recent research by Modern Retail shows, c-stores and grocery stores are including more dedicated spaces for customers to gather and socialize. These “third spaces” help retailers earn more revenue and entice shoppers to enter their stores and stay longer. Many convenience retailers also have incorporated indoor or outdoor spaces for community gatherings, from Friday night high school hangouts to Sunday morning gospel sings.

Third spaces were becoming popular before the pandemic hit,and retailers had to move away from these areas to establish social distancing measures. But these spaces are making their way into food stores and c-stores once again.

Also, because grocery stores have low margins, offering more than food can encourage customers to stay in store longer and entice them to spend more on higher margin items, says Brad Jashinsky, director analyst at Gartner.

The emergence of electric vehicles and the time needed to charge them is another reason why convenience stores can benefit from becoming more of a gathering space. Because these EV owners will have time on their hands to spend at c-stores while their vehicles recharge, this change of format could be a win-win for c-store operators as well as for their EV-driving customers.

The Third space organization tasks are solved with the same tried and true magic formula - KYC (know your customer). Mathematically this means that one has to combine the methodologies of customer study for specific industry (in this case, c-store), true traffic volume data for the exact place of interest, and demographic data for the area adjacent to the location. Since the redevelopment of a store is not done in a day, or even in a year, we have to add to the picture the traffic and demographic trends, which is what Ticon does with our 10-year data archive.

If you would like to learn more about our comprehensive traffic and demographic analytics, indispensable for redevelopment and upgrade planning of your C-Store or retail network, please contact us at info@ticon.co to schedule a demo.