C-Store Chains Growth Spurt Continues

Try TrafficZoom’s AADT metrics today with a free trial

Get instant access nowThe last couple of years, marked by the global COVID pandemic, impacted everybody and everything in many ways. One of these, especially relevant to convenience store operators, is shopping behavior.

People “learned” to make online shopping their primary activity, especially for bulk and volume purchases. And it looks like they increasingly favor convenience stores for daily necessities and quick consumption items.

Therefore, it is not surprising that convenience store operators, from big brand chains to small family firms, are rapidly expanding their presence and increasing both the number of locations and the range of geographic areas they cover.

For example, Sheetz expands into western Ohio with the addition of 20 new convenience stores over the next five years.

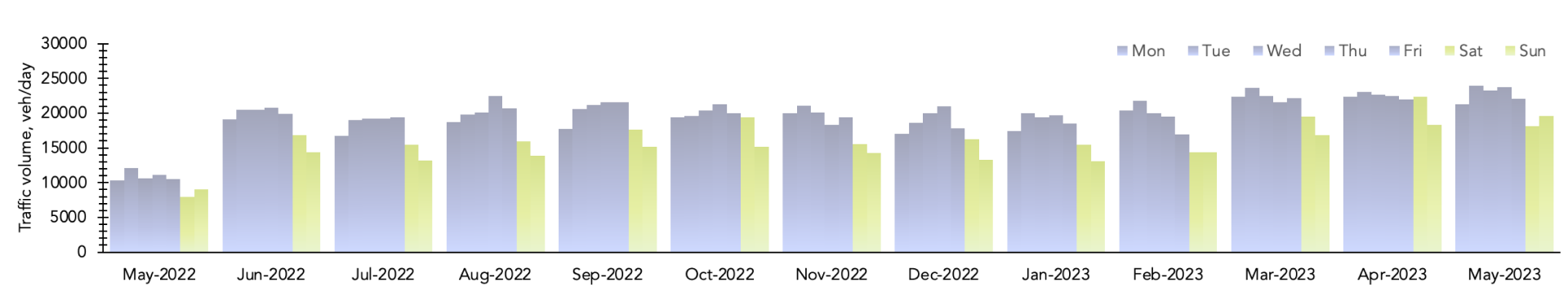

Another major c-store retailer, Wawa is focusing on the Florida Panhandle region, along with adjacent markets in South Alabama, with plans to double its footprint within the next decade, and is actively looking into sites for new stores.And when the giants go on the march, smaller players follow. Take Foxtrot, for example. There are currently 18 Foxtrot locations across Chicago, D.C., Virginia, and Dallas. But the retailer is planning to open four new convenience stores within the District of Columbia, Maryland, and Virginia (DMV) region by the end of 2022. This expansion will mark Foxtrot’s entry into Maryland, with its first store in the state debuting at the Bethesda Row shopping and dining destination.With so much growth on the market, we want to remind our readers that a thorough, careful, and data-based selection of your future location will be of critical importance for the success of that new c-store. Ticon provides you with the tools you need to support that strategic decision. Our industry-recognized product, C-Site InsightTM is specially designed to provide relevant and accurate information on traffic patterns, seasonal and intra-day variations, population behavior, and other critically important parameters.

The sample report with visual data graphs and expert analysis can be obtained at our website.